Why We Recommend Asset Protection Trusts in Living Trusts

Learn how asset protection trusts in living trusts can safeguard your children's inheritance from divorce and lawsuits.

You may need to amend your living trust if it has a bypass trust provision

A bypass trust or A/B trust was a staple provision in living trusts before the estate tax laws changed in 2011. Now, for most of our clients, a bypass trust is no longer needed, and it could actually make things worse.

The main reason bypass or A/B trust provisions were included in a joint living trust back in the day, was to avoid estate taxes. FYI - the “B” in A/B trusts means bypass trust. The “A” means survivor’s trust.

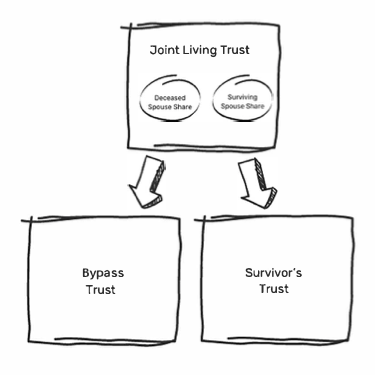

Many joint living trusts written prior to 2011, contain a mandatory bypass or an A/B funding provision, which means when the first spouse dies, the living trust assets must be split between two "sub-trusts" - the bypass trust and the survivor's trust.

The deceased spouse's share of the trust assets go into the bypass trust, and the surviving spouse's share go into the survivor's trust. For California residents, because of community property, this usually means a 50/50 split.

The bypass trust is irrevocable - its terms cannot not be changed. The survivor's trust is revocable - its terms can be changed, by the surviving spouse.

From 1997 until 2010, the estate tax exemption (the amount you could die with before there is an estate tax), ranged from $600,000 to $3,500,000. In 2011, the estate tax exemption was increased to $5,000,000, and in 2023, it is $12,920,000. Read more on the estate and gift tax.

Every person has an estate tax exemption. Married couples have two estate tax exemptions, one for each spouse.

In 2008, when the estate tax exemption was $2,000,000, a married couple could exempt up to $4,000,000 from estate tax.

In 2023, the estate tax exemption is $12,920,000. A married couple can exempt up to $25,840,000 from estate tax.

Most couples want the surviving spouse to be able to control and use all the trust assets and use the deceased spouse's estate tax exemption. Back in the day, this could only be done with a bypass trust.

If you simply gifted your share to the survivor's trust, you would lose your exemption. Without the bypass trust, the deceased spouse's exemption would be lost, and, as a family, you could only use the survivor's exemption when she died.

Example: Husband died in 2008, and he and his wife had a bypass trust provision in their living trust. They lived in California and the trust assets were community property. Husband's half of their trust assets were allocated to the bypass trust using his estate tax exemption.

Ten years later, when wife dies, her estate tax exemption could be used for the assets in the survivor's trust. By using the bypass trust the couple could capture husband’s and wife’s combined estate tax exemptions. Without the bypass trust, they could only use the wife's estate tax exemption.

Under the current estate tax law, unless you have a high net worth estate, there is no longer a need to use a bypass trust to avoid estate taxes.

A bypass trust is no longer needed for two reasons.

Compare the current $12,920,000 estate tax exemption with the 1997 estate tax exemption of $600,000 - huge difference!

For most couples, one exemption is more than their total estate value. There is no need to use both husband’s and wife’s exemption.

You should know that the estate tax exemption may decrease in 2026. Under the current tax law, if Congress and the President do nothing, then in 2026, the current law will sunset, and the estate tax exemption will decrease to approximately $6,800,000. But even at that lower amount, most couples will only need one exemption.

If you have a high net worth estate, and one estate tax exemption is not enough, there is another part of the current estate tax law that will allow you to avoid using a bypass trust. It’s called “portability.”

Portability means capturing your deceased spouse’s estate tax exemption amount by filing an estate tax return (IRS Form 706) when he dies.

Example: Married couple has a $10,000,000 estate. Husband dies in 2026, and the estate tax exemption is $6,800,000. If wife files an estate tax return for him, no estate tax will be owed. But by filing the estate tax return, she can “port-over” his $6,800,000 estate tax exemption. Porting-over his estate tax exemption means she can keep it, and her children can apply it when she dies.

The only way to port-over, or lock-in, the deceased spouse's estate tax exemption is by filing a Form 706 estate tax return - even though no tax will be owed.

Example. If when wife dies, the total estate is $10,000,000, and the estate tax exemption in the year she dies is $7,500,000, there would be an estate tax. $10,000,000 estate - $7,500,000 estate tax exemption = $2,500,000 subject to the estate tax of 40% - yikes!.

However, if she ported-over her husband’s $6,800,000 estate tax exemption by filing the estate tax return, her family can use his $6,800,000 exemption and her $7,500,000 exemption for a combined $14,300,000 estate tax exemption - more than enough to cover the $10,000,000 estate, therefore, no estate tax.

But if wife had not ported-over husband’s estate tax exemption by filing the estate tax return, there would be an estate tax.

By porting over her husband's estate tax exemption, wife could use her husband's estate tax exemption without using a bypass trust.

For some time, we have been using a "disclaimer trust" provision in most of our married couple's living trusts.

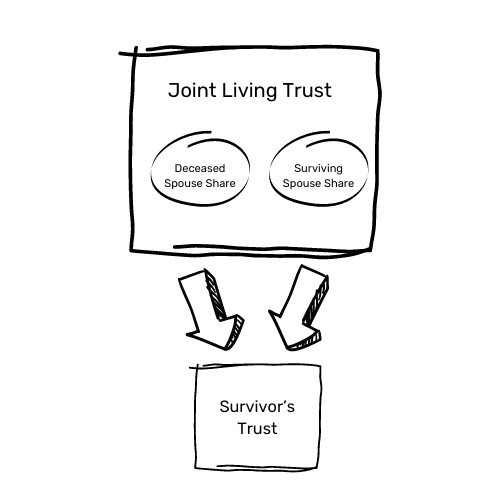

Living trusts with disclaimer provisions are written so that at the first death, the survivor's share of the trust assets and the deceased spouse's share of the trust assets will, by default, be allocated to the survivor's trust.

But, the disclaimer trust provision also gives the surviving spouse the option to disclaim some or all of the deceased spouse's share. Any assets disclaimed, will be allocated to a bypass trust or to a qualified terminable interest trust (QTIP trust).

The bypass trust can be used for a high net worth estate. The QTIP trust can be used for a second marriage, blended family situation. For more info on bypass trusts v. QTIP trusts click here.

The disclaimer trust provision allows the deceased spouse's share of the trust assets to go to the survivor's trust, rather than to a bypass trust. And because of portability, the bypass trust is not needed to capture the deceased spouse's estate tax exemption.

If all the assets are allocated to the survivor's trust, the trust administration is easier, and the surviving spouse will have full control of all the trust assets. This works great so long as you are ok with the surviving spouse having full control of all the trust assets.

If all the trust assets are allocated to the survivor's trust, all the trust assets will receive a "step-up" tax basis when the surviving spouse dies. Tax basis is the amount you subtract from net sales price to determine your capital gain.

The tax basis of an assets is the purchase price. For real property, the tax basis is purchase price plus the costs of any improvements you make to the property.

If you sell your home, you will have a capital gain if the net sale proceeds are greater than the tax basis.

Net sales proceeds - tax basis = capital gain

Example: Husband and wife purchased their home 40 years ago for $100,000. Their tax basis is $100,000.

They sell their home for $2,000,000, and net $1,800,000. Their capital gain will be the net sale proceeds minus the tax basis ($1,800,000 minus $100,000 = $1,700,000). That will result in a big capital gain tax.

They can use their Internal Revenue Code Section 121 capital gain exemption and exclude $500,000 of the capital gain, but they will still have a big capital gain tax.

However, the tables are turned when you pass away still owning the assets.

When you pass away, the tax basis in those assets gets "stepped-up" to the date of death value.

Using the above example, if the home was worth $2,000,000 when husband died, the new "stepped-up" tax basis would be $2,000,000 (the date of death value), and not $100,000. If wife decides to sell it shortly after, she would have no capital gain.

If wife doesn't sell the home, there can be a second step-up in basis when she dies.

Let's say when she dies the home is worth $3,000,000. When she dies, the home gets another step-up. The new stepped-up basis will be $3,000,000 (date of death value). And if her children sell the home soon after, there will be no capital gain tax.

However, there is no second step-up in basis for assets in a bypass trust. Step-up in basis only works for assets owned by an individual or by a "grantor trust." Grantor trusts are trusts in which the IRS consider a living person to be the owner. Living trusts and survivor's trust are grantor trusts.

You know what is not a grantor trust? A bypass trust.

Unlike the survivor's trust, the bypass trust is not a grantor trust, it has its own tax identification number, and the assets in it are not considered to be owned by an individual.

Assets in the bypass trust do not receive a step-up tax basis when the surviving spouse dies. If the surviving spouse lives a long time after the deceased spouse, and the home or other assets grow in value, there will be a capital gain tax when the children sell the bypass trust assets after the surviving spouse dies.

Example. Couple bought home for $100,000. When husband dies, the home is worth $2,000,000. The step-up basis is now $2,000,000. Ten years later, when the surviving spouse dies, the home is worth $3,000,000.

If, when the first spouse died, the home was transferred to the bypass trust, the home's tax basis would have been fixed at $2,000,000 (husband's date of death value). There will be no second step-up in tax basis when the surviving spouse dies.

If the children sell the home after the surviving spouse dies, their capital gain will be the net sale proceeds minus $2,000,000, which will result in a capital gain.

But, instead, if the home was transferred to the survivor's trust, there would be a second step-up tax basis when the surviving spouse died. And when the children sold the home, there would be no capital gain.

Many living trusts that were written before 2011 include a mandatory bypass provision. Unless the living trust is amended, then when the first spouse dies, half the assets must be allocated to a bypass trust. And, as described above, this could cause capital gains tax problems when the surviving spouse dies.

If your living trust has a mandatory bypass provision, and if you do not have a high net worth estate, you should amend your living trust to remove the mandatory bypass trust provision and replace it with a disclaimer trust provision. Your children will thank you.

Learn how asset protection trusts in living trusts can safeguard your children's inheritance from divorce and lawsuits.

If you have a living trust, your trustee must begin the trust administration when you pass away.

How to transfer your assets to your California Living Trust to avoid probate